Capitalism got us in here, Capitalism can get us out!

February 23, 2009

Mr. Tim Geithner

Secretary of the Treasury

C/o Department of the Treasury

1500 Pennsylvania Ave., NW

Washington, DC 20220

-Via fax: 202 -622-6415

Dear Mr. Geithner:

From down here in the trenches, I would like to propose a strategy to the housing and

debt crisis and perhaps the recession itself that involves NO government investment and

by design gets us out of this mess, as fast as possible The American Way!

A Contribution Not a Purchase and Sale

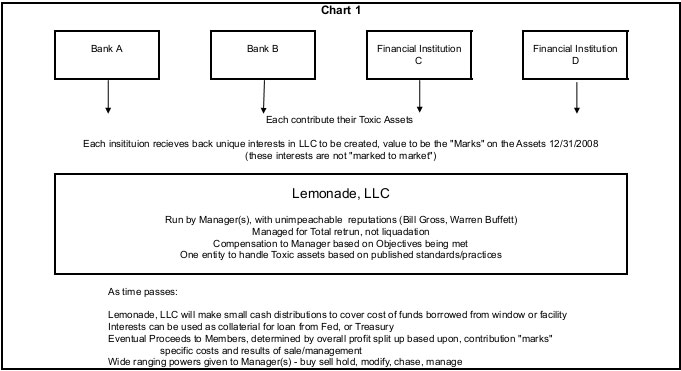

I suggest that we set u p a new entity to be managed by one or more of our citizens whose

reputations are still unscathed by recent events All the banks that own these toxic assets

then contribute them into the organization in exchange for unique ownership interests.

You as Treasury Secretary in conjunction with Mr. Bernanke over at the Federal Reserve

would see to it that the banks can use these securities of the LLC as collateral for

borrowing so they have access to cash to make new loans. This might help America. (see

Chart 1 )

These LLC interests would have a distribution rate equal (plus or minus) to the Federal

Funds target rate, this will allow the banks to borrow against them for “free.” What their

real yield or rate of return is will be determined over time.

Cash would accumulate to help the Total Return

The LLC would end up accumulating cash as the rate of interest on the toxic assets (the

vast majority of which are still paying) would be well in excess of the distribution rate.

Carryover of the Current Marks

The value of the LLC interests on the books of the contributing institution would be equal

to the marks that institution currently has on the contributed assets and would be frozen at

that level until such time as you, the Chairman of the Fed and the Manager(s) can come

to a consensus that true market value of the underlying assets can be determined and

hence a real value determined of the LLC interests.

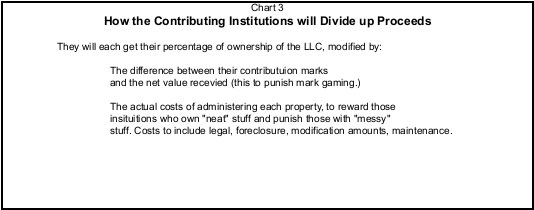

Each of the institutions contributing toxic assets will likely have somewhat different

marks, that’s fine. They each get to use their own marks as the new value. Subsequently

if it’s found that the management of the contributing institution had the assets marked at

prices that are fraudulent, then the justice department can prosecute them under

Sarbanes/Oxley. But to equalize those marks, and keep one institution from profiting by

having different marks, the eventual return to each contributing institution based upon the

unique profit on its’ contributed assets, so one institution with lower marks will get more

money back from it’s investment in the LLC than an otherwise identical institution

The Manager would be in complete charge of running the business whose objective is

NOT to liquidate the portfolio (like RTC) but to manage it for total return and to return as

much as possible to the banks. This provision is to try to keep more foreclosures from

hitting the markets and further depressing the real estate markets. We need to put these

toxic assets in the hands of someone who can manage them long term and is not under

constant stress due to the marks and liquidity issues.

The Managers may decide to create a series of REITS, and sell off shares, or parse the

assets and sell off tracking shares to foreigners, perhaps even sell shares of the LLC (a

fungible ver sion) in the public markets. All manner of long term investors might be

interested in an un -leveraged portfolio of such assets. The Managers might also choose to

lever up the portfolio although I can’t see why that might help at this juncture.

Total Return Perspective not Short Term

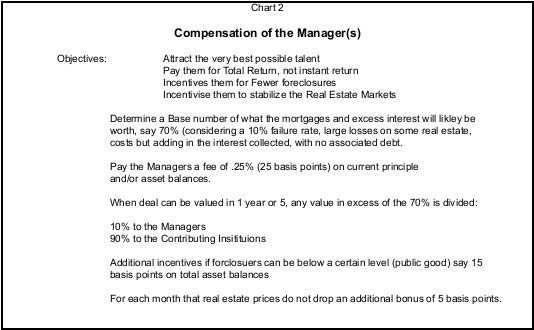

The Managers must be well compensated so we get the “A” team. They earn fees by

managing the portfolio, not necessarily foreclosing but modifying the mortgages when it

makes sense from a “total return” perspective. I have outlined a possible compensation

scenario on Chart 2.

Not a “Good Bank/ Bad Bank” Plan

This is not a “good bank/bad bank” deal as I understand the term has been tossed around

up there. There would be no purchase and sale of the assets; instead they are contributed

to the new LLC. With the eventual return to the contributing bank depending on the real

value realized over a longer term not today’s “marks”.

This plan will make the Manager(s) of the LLC a lot of money, more if real estate values

stabilize, more if the rate of foreclosure slows down, more still if they manage the

portfolios well, this is the American way, one we haven’t seen in a while, but we can if

you execute on a plan like this. I believe it also puts time on the side of success (long

term view) instead of the mortal enemy of this process (trying to avoid re-marking the

assets down each time real estate prices tick down) Also it leverages the coupon on the

mortgages vs. the Federal Funds rate and turns that into a profit generator and also gives

these the banks access to more capital, via the faculties, I believe have already been setup

so they can make new loans.

Please create a Strategy that involves Capitalism !

Your people will come up with lots of things that need to be p olished in this simple plan,

as our leader in this matter, I ask you to tell them to treat the plan as one you came up

with and polish it accordingly.

Sincerely,

Charles S. Stoll

CC: Bill Gross, Pimco

Warren Buffett, BKHT Omaha

Pres B .Obama, D.C.

PS: Mr. Secretary, don’t you think it’s time you called over to the SEC and quizzed them

about why they are not bringing back the up -tick rule? Something appears amiss.

PSS: In a couple of weeks my new book Your Lottery Gene, will be ready , it is all about

the affect of easy money on people whether it’s a winning lottery ticket, a inheritance or

just easy credit, I will send you a copy, but if you should want extra copies check it out

on my website wwww.combatbusinesswizard.com.

The opinions expressed in this letter are those of the author and do not reflect or represent

the opinions of Mutual Service Corporation or LPL Financial.

Comments are closed